For practicing what we’ve learned in financial classes in the 2nd term of MBA, our team decided to join Go Green in the City Business Case Competition, organized by Schneider Electric. We designed a business plan addressing our solar energy solution. 1450 projects were presented and we were one of the 50 teams around the world qualified in the semi-final list. I was mainly focusing on financial modeling and impact analysis, such as ROI and payback period. I would like to share some of findings and insight here.

Goal of the project:

- Evaluate the Return on Investment of our solution by analyzing quantitative data

- Identify the ideal market to penetrate by examing macroeconomic data

- Evaluate the attractiveness of the investment by benchmarking performances of different industrial companies

Intro of Wiser Home Control 2.0:

Before starting the analytic, let me give the reader a brief intro of the solution we’ve proposed in the competition — Wiser Home Control 2.0, a peer-to-peer energy trading solution with an app monitoring energy consumption, trading, and other smart home features.

Business Model

Schneider Electric will take the lead in this business including engineering, procurement, and construction. The residential market is booming in emerging markets and this gives the company the opportunity to strengthen its position in the B2C market. The idea is to combine the strength of Schneider Electric, which is energy management, with a consumer application and energy trading. Schneider Electric will enter the retail market and create a new customer segment. It can ally with 3rd parties such as system integrator, software developer or retailer. The financial analysis assumes that Schneider Electric owns the entire value chain.

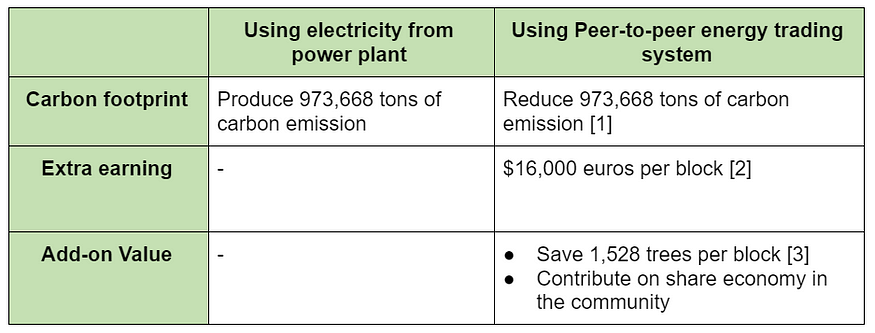

Comparative Analysis

Impact Analysis

The application has the potential to save 458,400 tons of CO2. Equivalent greenhouse gas emissions from a vehicle to run 6943km, which can circle around the earth 97732 times and save around 20 million trees.

Users of the product can generate revenue of up to $16,000 euros per year (per block) from selling excess energy from their solar panels.

Financial Analysis

Schneider Electric can generate an internal ROI of up to 32% given the cash flow assumptions above, with a payback period of 2.4 years.

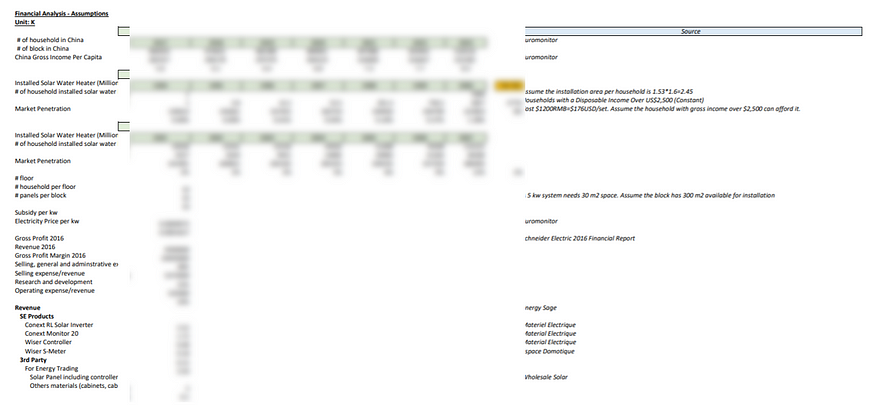

The financial analysis is actually the most time-consuming part of the competition. I summarize the major tasks:

- Macroeconomic data collecting

I used Euromonitor as the main resource in order to get an idea regarding the affordability and the market size of the target market to penetrate. There are many factors influencing the market size estimation, such as population, disposable income, housing size…even average hours of sunshine in a day is crucial!

2. Making a reasonable assumption

Given there are various household types, I needed to decide which segment of customers to target by benchmarking their purchasing behavior in general.

3. Put all the things together and benchmarking with the financial performance of Schneider Electric to check the attractiveness

The financial reports from Schneider Electric and the competitors in the same industry are my main focus. These reports gave me an insight about what would be the expectations of the investors and what is the portion in the pie we are addressing.

After weeks of data collection and number crunching, here are some snapshots of the result:

Conclusion and what we might be wrong?

It sounds a good deal from the number perspective, an ROI of 32%, and a payback period of 2.4 years. However, we couldn’t neglect the fact that there might be competitors enter the market in the 2nd or 3rd year, affecting the business. Also, technology readiness is only one factor of the overall consideration, we haven’t checked the local regulation to see whether peer-to-peer energy trading is feasible.